|

|

|

The Latest Hot Investment: Wine

Posted by perle0 on 2006-12-18 23:25:00

(3912 views)

|

[News]

[USA] |

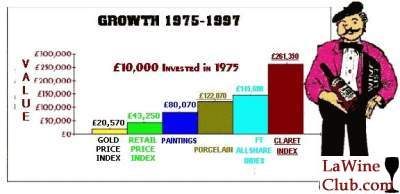

A recent study by economists at the University of Wyoming found that high-end wine has been an investment with very low relative risk and reliably high returns. A recent study by economists at the University of Wyoming found that high-end wine has been an investment with very low relative risk and reliably high returns.

Looking at red Bordeaux auction prices over a period from 1996 to 2003, they found that the average annual return on investments in Bordeaux was between 7.5 percent and 9.5 percent higher than would have been predicted by factors that account for risk, making it a better investment choice than almost any other option. The best investment found in the study was the 1966 Haut-Brion, which posted an average monthly return of about 7.5 percent during their sample period. Still, 75 wines studied were found to have average monthly returns in excess of 1 percent per month.

That's one free-flowing bottle. |

|

Why does wine make for such a good investment? Well, for one thing, it has value beyond the obvious. Besides being pleasant to drink, a high-end wine is often used to mark a special occasion, regardless of the state of the surrounding economy. And the stately, well-known classics are generally made in limited quantities--once the grapes grown in Bordeaux are gone, they're gone. You can't print more (money), mine more (gold), issue more (stocks and bonds), etc. So there's a built-in scarcity factor, which only increases when we finance-impaired idiots actually DRINK the stuff, wasting perfectly good investment material.

Actually, that's one of the great flaws with wine as a do-it-yourself investment strategy: it so easily turns into a drink-it-yourself strategy, when fallible humans find themselves unable to resist that exquisite bottle winking at them from across their cellar. (Or worse, they have spouses who accidentally grab that special bottle instead of the Two-Buck Chuck or teenagers who figure the 'rents will never miss one bottle amongst so many....) Or, y'know, a hurricane drowns your whole city, leaving your wine a.) underwater for x weeks, or b.) broiling in the 90-degree heat for a month or so.

To combat this, wine investment funds are beginning to crop up. There's already one based in London, and if the returns continue to maintain spectacular levels, they'll surely catch on here. Since you're buying shares in a fund and the wine is kept elsewhere, you're never tempted (or allowed) to drink it. Sadly, if too many people start to do this, though, the investment value will likely go down. Why? 95% of wine buyers today probably intend to drink it someday, so those rare Bordeaux don't get sold very often. When funds are buying it as investments, they pretty much have to sell it someday to reap the return...which means there'll be more wine on the market, decreasing the scarcity and lowering the wine's value. Catch-22.

I say, if you want to invest in wine, buy the bottles and have a very firm back-up plan for keeping it safe and cool in times of hardship. Then, even if the stock market AND the wine market crash at the same time, you still have something nice to drink. |

Details. |

|

|

|